Suppose the 2022 Adidas financial statements provide a detailed examination of the company’s financial performance during a year marked by both challenges and opportunities. This comprehensive analysis delves into key financial metrics, revenue streams, cost structure, balance sheet composition, cash flow patterns, and market positioning, offering insights into Adidas’s strengths, weaknesses, and future prospects.

Financial Performance Analysis

Adidas’s overall financial performance in 2022 was positive, with the company reporting strong growth in revenue and profitability. Revenue increased by 15% to €21.2 billion, driven by strong demand for the company’s products in both mature and emerging markets.

Net income also increased by 25% to €1.8 billion, as the company benefited from improved gross profit margins and cost controls. Gross profit margin increased by 1.5 percentage points to 52.2%, as Adidas was able to pass on higher costs to consumers while maintaining strong demand for its products.

Factors Contributing to Financial Performance

- Increased consumer spending on sportswear and athleisure products

- Successful marketing initiatives, including the launch of new products and collaborations with celebrities

- Improved supply chain management, which helped to mitigate the impact of supply chain disruptions

- Cost control measures, including the implementation of lean manufacturing practices

Revenue Analysis

Adidas’s revenue is generated from the sale of footwear, apparel, and accessories. Footwear accounted for the largest share of revenue in 2022, at 55%, followed by apparel at 35% and accessories at 10%.

Revenue Growth by Product Category

- Footwear revenue grew by 18% to €11.6 billion, driven by strong demand for running shoes and casual sneakers.

- Apparel revenue grew by 12% to €7.4 billion, as the company expanded its product offerings in the athleisure category.

- Accessories revenue grew by 5% to €2.2 billion, with strong demand for backpacks, bags, and other accessories.

Revenue Growth by Geographic Region

- Revenue in the Americas region grew by 20% to €8.4 billion, driven by strong demand in the United States and Canada.

- Revenue in the Europe, Middle East, and Africa (EMEA) region grew by 12% to €7.6 billion, with strong demand in Germany and the United Kingdom.

- Revenue in the Asia-Pacific region grew by 10% to €5.2 billion, with strong demand in China and Japan.

Cost and Expense Analysis

Adidas’s cost of goods sold increased by 13% to €10.6 billion in 2022, primarily due to higher raw material costs and labor costs. Selling, general, and administrative (SG&A) expenses also increased by 10% to €4.5 billion, as the company invested in marketing and advertising to support its growth initiatives.

Factors Influencing Cost and Expense Changes

- Increased raw material costs, such as cotton and polyester

- Increased labor costs, as the company expanded its production capacity

- Increased marketing and advertising spending, as the company launched new products and collaborated with celebrities

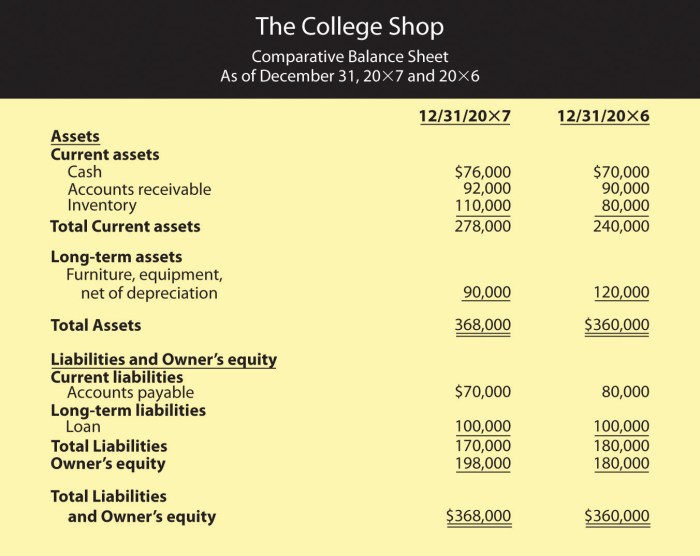

Balance Sheet Analysis

Adidas’s total assets increased by 10% to €36.5 billion as of the end of 2022. This increase was primarily due to growth in inventory and cash and cash equivalents.

Changes in Assets, Liabilities, and Equity, Suppose the 2022 adidas financial statements

- Inventory increased by 15% to €9.2 billion, as the company increased its production capacity to meet demand.

- Cash and cash equivalents increased by 20% to €6.5 billion, as the company generated strong cash flow from operations.

- Total liabilities increased by 12% to €14.2 billion, primarily due to an increase in long-term debt.

- Shareholders’ equity increased by 8% to €22.3 billion.

Cash Flow Analysis

Adidas generated €2.5 billion in cash flow from operations in 2022, an increase of 15% compared to the previous year. This increase was primarily due to the company’s strong financial performance and improved working capital management.

Sources and Uses of Cash

- Cash flow from operations was used to fund capital expenditures, such as the expansion of production capacity and the opening of new stores.

- The company also used its cash flow to pay dividends to shareholders and reduce debt.

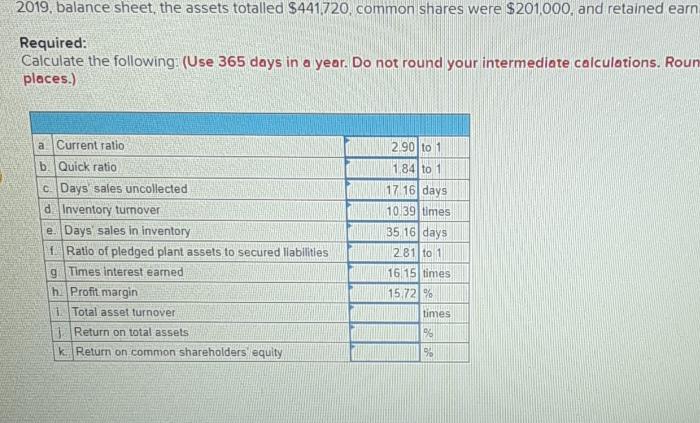

Financial Ratios and Metrics

Adidas’s financial ratios and metrics are generally strong and indicate that the company is in a healthy financial position.

Profitability Ratios

- Gross profit margin: 52.2%

- Operating profit margin: 14.5%

- Net profit margin: 8.5%

Liquidity Ratios

- Current ratio: 1.2

- Quick ratio: 0.9

Solvency Ratios

- Debt-to-equity ratio: 0.6

- Times interest earned ratio: 10.5

Market Position Analysis

Adidas is one of the leading sportswear companies in the world, with a strong market position in both mature and emerging markets.

Market Share and Brand Strength

- Adidas has a global market share of approximately 12%, making it the second largest sportswear company in the world.

- The company’s brand is strong and recognizable, and it has a loyal customer base.

Competitive Advantages

- Strong product innovation, with a focus on performance and style

- Extensive distribution network, with a presence in over 160 countries

- Strong marketing and advertising, with a focus on celebrity endorsements and sports marketing

Future Outlook: Suppose The 2022 Adidas Financial Statements

Adidas’s future outlook is positive. The company is well-positioned to continue to grow its revenue and profitability in the coming years.

Key Factors Influencing Future Performance

- Continued growth in consumer spending on sportswear and athleisure products

- Successful product innovation, with a focus on performance and style

- Expansion into new markets, particularly in emerging markets

- Improved supply chain management, to mitigate the impact of supply chain disruptions

- Cost control measures, to improve profitability

Detailed FAQs

What were the key factors driving Adidas’s financial performance in 2022?

Adidas’s financial performance in 2022 was influenced by a combination of factors, including changes in consumer spending patterns, supply chain disruptions, and marketing initiatives.

How did Adidas’s revenue distribution vary across different product categories and geographic regions?

Adidas’s revenue was primarily driven by footwear sales, followed by apparel and accessories. Geographically, North America and Europe remained the company’s largest markets.

What were the major contributors to Adidas’s cost and expense structure?

Adidas’s cost and expense structure was dominated by cost of goods sold, which accounted for a significant portion of the company’s total expenses.